What is NetSuite General Ledger?

NetSuite general ledger (GL) automates core accounting processes and provides a flexible structure that adapts to the needs of any organisation. Customise account types, transactions and reporting segments to meet unique business requirements. Reduce reliance on manual data entry with real-time bank integration, rules-based transaction matching and auto-posting of journal entries. NetSuite gives finance and accounting professionals the tools they need to maintain accurate financial records, produce detailed reports and close the books on time.

Trust Your Data

Say goodbye to broken formulas in spreadsheets. With all your finances in one place, you get accurate figures and effortless reconciliation.

Static to Dynamic

Your general ledger should support the unique structure and requirements of your business. NetSuite lets you control how your GL operates with custom workflows, transaction types and more.

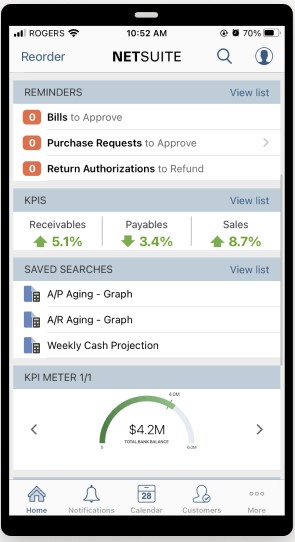

Run Your Business Anywhere

Access your books anytime, from any internet-connected device — phone, tablet or computer — so you’re always on top of business financials.

NetSuite General Ledger Features

The general ledger is the core of every accounting system. It must be dynamic, adaptable and scalable. NetSuite general ledger gives companies the flexibility, insights and control they need to keep up with fast-changing business requirements.

Automation

Eliminate manual journal entries. Adding custom GL impact lines to transactions across single or multiple accounting books reduces the time and effort required for account reconciliation, closes and audits. Automated journal-entry approval workflows verify criteria, like threshold amount and approval limits, before the journal is posted. NetSuite GL automates amortisation and depreciation schedules, P&L allocations and other routine calculations.

Multiple Currencies & Tax Structures

Maintain accurate tax records, with the correct details in the right currencies, wherever your customers and partners do business. Record transactions in both the local currency and your company’s base currency — simultaneously. Automatically manage currency conversions using up-to-date exchange rates, saving time and minimising errors. NetSuite eases compliance with local and international tax rules, including income, VAT and other sales and use levies.

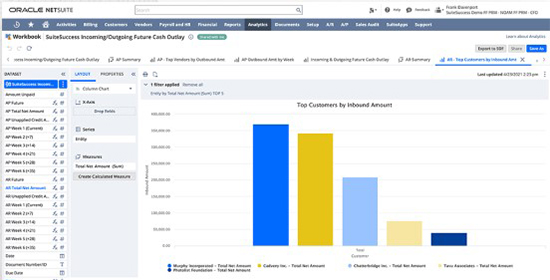

Segments

Define unlimited custom GL segments, such as profit center, fund, program, product line and more, in addition to standard subsidiary, class, department and location segments. Improve accuracy and save time by ensuring adherence to double-entry accounting principles and balancing data across all segment combinations.

Banking Integration

Get cash flow insights at a glance. Connect to thousands of financial institutions around the world, automatically import bank and credit card data into NetSuite and reconcile statements with general ledger accounts. An intelligent rules engine compares bank data with existing transactions, automatically reconciling matching entries and flagging exceptions so they can be addressed.

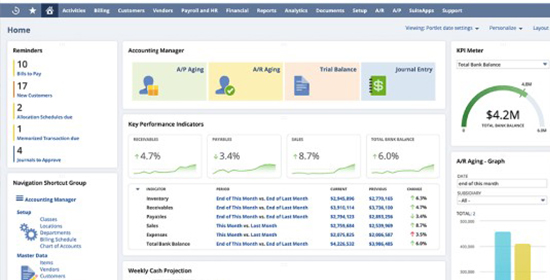

Budget Tracking

Gain the ability to track — in real-time — revenue and expenses against predefined budgets created with NetSuite Planning and Budgeting or imported as .csv files.

Multiple Books

Eliminate data entry replication and reduce the need for error-prone manual adjustments to your accounting and reporting processes with NetSuite multi-book accounting capabilities.

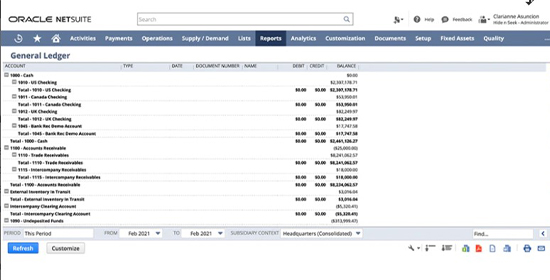

Chart of Accounts

Say goodbye to complex tracking codes and hello to a simplified chart of accounts structure that organises financial and statistical data for simplified reporting.

Reporting

Custom reporting segments allow multidimensional analysis of financial and operational data. Automatically consolidate subsidiary financials and create reports under multiple accounting standards. Schedule reports to be generated and emailed daily, weekly or monthly.

General Ledger Benefits

Add Efficiencies

Save time with automated journal entries, data imports, transaction matching and bank reconciliation.

Increase Accuracy

Eliminating the need for complex GL codes improves the quality of reporting data.

Make Better Decisions

Custom reporting segments and multidimensional analytics deliver the information you need to make sound business decisions.

Go Global

Create different sets of books to comply with local and international accounting standards, tax rules and reporting requirements.

Faster Consolidation

Roll up financial results from subsidiaries automatically, without the need for manual adjustments.

Easier Closes

Minimise data-entry errors, missing transactions and other issues that delay the close process with automated account reconciliation and exception management.