Finance Golden Rules for Small Businesses

Finance Golden Rules for Small Businesses

According to Dunn & Bradshaw, 80% of small businesses fail due to bad financial management.

When you’re getting on with “the day job” of supplying goods and services, it’s easy to forget about the “mopping up” which comes at the end of the process.

Here are some golden rules of running your finance system, for small businesses, which will help you keep afloat in even the most difficult of circumstances.

Rule #1 Measure

The old adage goes: What gets measured, gets done.

Whilst that is true, I like to elaborate: What gets measured, gets improved upon.

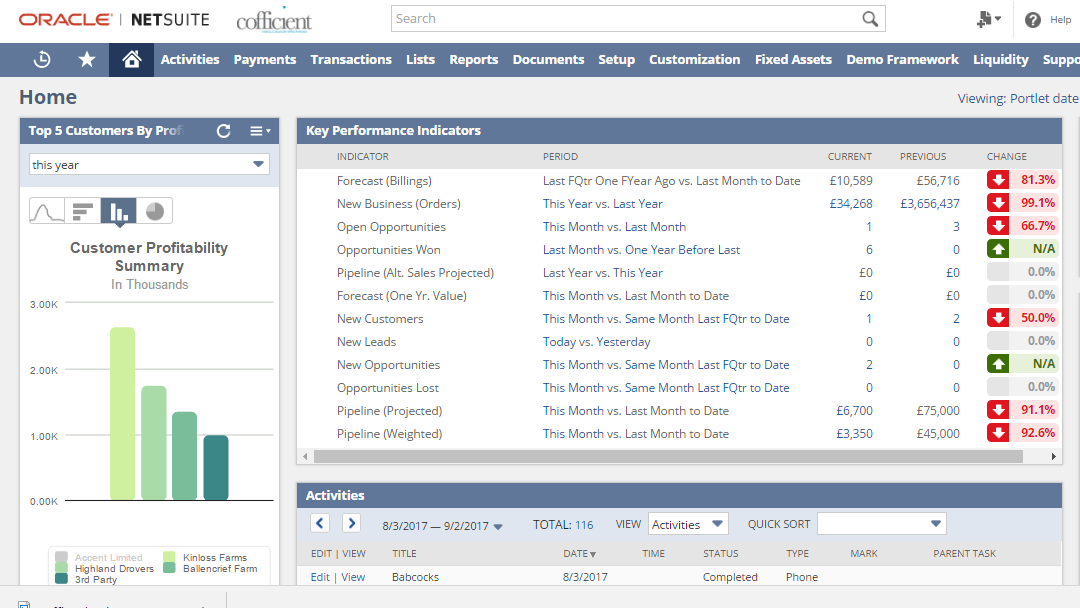

Whether you are measuring your most profitable customer or your most commonly sold goods, the power in knowing your business is unparalleled.

How can you be expected to increase profitability if you don’t know what makes you money?

A cloud based finance system for small business will help, even the most technically challenged, to access and leverage this powerful information in real-time.

Rule #2 Assign the right values to the right things

It’s dead easy to assign a value to the cost of goods. But are you taking everything into account?

For example, if you charge for postage, are you accounting for the correct cost per item? Do you consider packaging? Weight of good sold?

Or do you understand the true cost of sale? Do you consider marketing and sales effort when calculating the profit of your goods or services?

Do you undertake analysis of cost of travel or expenses?

Your finance system should help you to attribute all your cost lines to your product and service so that you get a true value of profitability after all is said and done. Only then will you really understand where you are making money (and where you are spending it needlessly).

Rule #3 Invoice Promptly

Many small businesses, due to time constraints, will set aside a bank of time to raise all the relevant invoices for a certain time period. Imagine if someone had purchased from you on the 1 of the month but you don’t sit down to raise the invoice until the 28 of the month. Now multiply that several times over. That’s how much revenue you could have had, secured in your bank, if you had raised an invoice promptly.

Many finance systems have neat little portlets, which indicate goods/services sold and subsequent invoices to raise. The customer details and details of sale should be tucked safely into your system so there’s no excuse these days for having to “hand crank” and invoice.

A really good finance system will have an email engine which will allow you to email customers their invoice direcrtly.

Imagine logging into your system each morning and seeing a dashboard with a real time “Invoices to Order” number. Now imagine being able to, at the touch of a button, generate and email all those invoices.

There really shouldn’t be a need to set aside time to do invoicing. It doesn’t have to be an onerous task.

#Rule 4 Credit Control Effectively

There’s given credit terms. Then there’s taken credit terms. Late payments are on the increase (and some sectors are notoriously bad).

Nearly 3 in 5 small businesses have had to suspend services because of late payment [Hilton-Baird]. It pays (literally) to get good at chasing this.

You will always get customers who keep their cash in their pockets for as long as they feasibly can.

Be consistent with your debtors and let them know when they are overdue. Most people will pay after one or two reminders.

But if your debtors know that you’re not really going to chase them; or that you only chase when you have time; you’re giving them an opportunity to renege on their payment responsibilities. All this chasing takes time.

As a direct result of late payments, 79% of businesses were forced to invest more time in chasing invoices, 48% had to pay their suppliers late, and 30% had to increase borrowing. 10% had to turn down new business. [Source: Hilton-Baird]

The answer is to automate your credit control routine. Get the system to chase it for you.

A pre-programmed Dunning routine should be set up within your system, with escalating severity, in order to jolt your late payers into action. It might not clear all your aged debt, but at least you’ll be spending your precious time on managing the exceptions alone.

It pays (literally) to get good at chasing this.

Written by Paul Grant (CA) – Director at Cofficient Ltd

We provision cloud based business software for small businesses around the UK.

To talk to someone about our NetSuite Dunning Credit Control App please get in touch

[su_button url=”www.cofficient.co.uk/contact” style=”3d” size=”5″ center=”yes” icon=”icon: book”]Talk to Paul about Dunning for NetSuite[/su_button]