A Yearlong Guide to Organising Your Business Finances

A Yearlong Guide to Organising Your Business Finances

Every business on the planet has one thing in common: they all exist to make money. From the smallest local business to multinational organisations, every business needs to have a yearlong plan to organise their finances. Today, we are giving you a quarter-to-quarter timeline that will help you organise your finances regardless of your company’s current financial state.

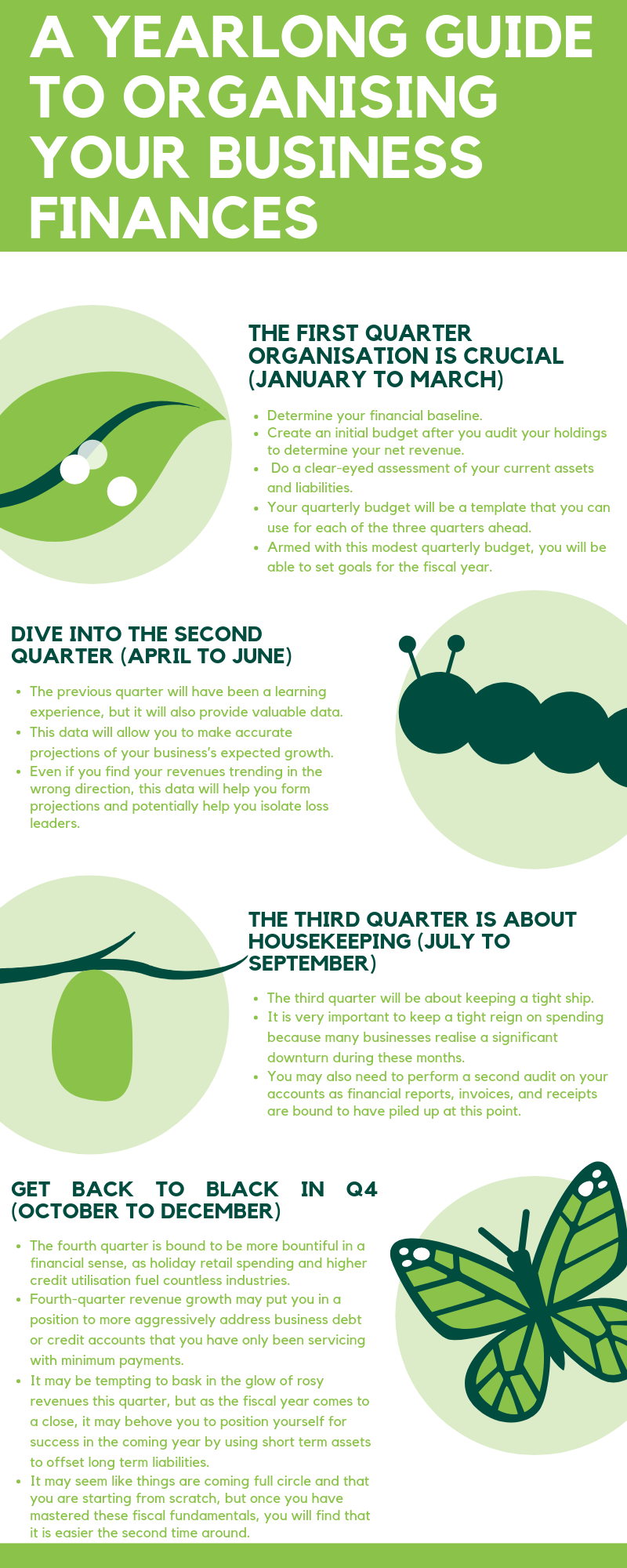

The First Quarter Organisation Is Crucial

The first quarter of the fiscal year is between January and March, and this period of time is when you need to determine your financial baseline. You must create an initial budget after you audit your holdings to determine your net revenue. Before you can create a budget that you can stick to, you will need to have a clear-eyed assessment of your current assets and liabilities. Your quarterly budget will be a template that you can use for each of the three quarters ahead. Operating within your means in this first quarter will make it easier to balance your budgets without making huge adjustments in the future. Armed with this modest quarterly budget, you will be able to set goals for the fiscal year.

Dive Into The Second Quarter

The timid moves of the first quarter may not be your style, but the good news is that in the second quarter of the year you will have the latitude to take some risks. The months of April through June will be when you can set up some impressive power moves in your financials. Your previous quarter will have been a learning experience, but it will also provide valuable data. This data will allow you to make accurate projections of your business’s expected growth. Even if you find your revenues trending in the wrong direction, this data will help you form projections and potentially help you isolate loss leaders. This quarter will provide an opportunity to evaluate whether they should continue. In some cases, loss of profit in the short term may be worth it in order to get ahead of the competition and capture valuable market share for you to capitalise in the future.

The Third Quarter Is About Housekeeping

The third quarter of the fiscal year, between July and September, will be about keeping a tight ship. You will need to closely track your spending as summertime months tend to realise unexpected expenses. This can be travel or spending on marketing. It is very important to keep a tight reign on spending because many businesses realise a significant downturn during these months. You may even find yourself operating deeply in the red, but don’t panic. However, if you can keep a tight cap on spending during this quarter, you will have the fourth quarter to look forward to. You may also need to perform a second audit on your accounts as financial reports, invoices, and receipts are bound to have piled up at this point. You don’t want a bottleneck of paperwork when it comes time to close out the fiscal year.

Get Back To Black In Q4

The fourth quarter is bound to be more bountiful in a financial sense, as holiday retail spending and higher credit utilisation fuel countless industries. Fourth-quarter revenue growth may put you in a position to more aggressively address business debt or credit accounts that you have only been servicing with minimum payments. It may be tempting to bask in the glow of rosy revenues this quarter, but as the fiscal year comes to a close, it may behoove you to position yourself for success in the coming year by using short term assets to offset long term liabilities. It may seem like things are coming full circle and that you are starting from scratch, but once you have mastered these fiscal fundamentals, you will find that it is easier the second time around.

How does your business management its finances all year round?

An effective financial management system improves short and long-term business performance by streamlining invoicing and bill collection, eliminating accounting errors, minimising record-keeping redundancy, ensuring compliance with tax and accounting regulations, helping personnel to quantify budget planning, and offering flexibility and expandability to accommodate change and growth.

Get in touch to find out if one our solutions fits your business needs.